Asset Allocation with Generative AI Part III: Generative Factor Model

Summary of the talk given at the 6th Annual Korea Quantitative Investment Conference 2022

The series on the topic ‘Asset Allocation with Generative AI’ consists of the following 3 sections.

Part 1: Motivation behind Generative Approaches

Part 2: Factor Investing in Asset Allocation

Part 3: Generative Factor Model

In this section, we will explore the Quantitative Generative AI model developed at Akros Technologies.

Factor Generator: Asset Allocation with Generative AI

Structure and Training of the Factor Generator

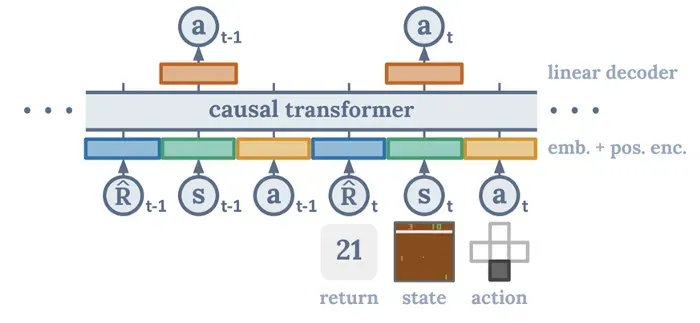

The deep generative model that we have developed at Akros to find macroeconomic alphas more efficiently s is called Factor Generator. The backbone network that we use is a model called Decision Transformer which was proposed in the paper ‘Decision Transformer: Reinforcement Learning via Sequence Modeling’ by Lili Chen in 2021. It is an offline reinforcement learning model based on a causal transformer that is achieving state-of-the-art performance in various tasks thereby demonstrating the ability to generalize in many different contexts.

One of the most interesting aspects of a decision transformer is the way the model is trained. The training dataset consists of three types of information which are summarized by Figure 2.

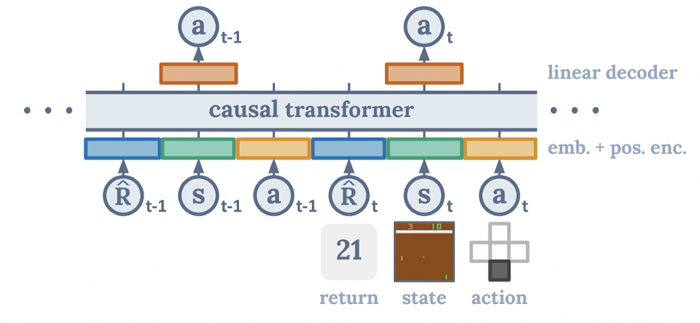

One is an incomplete factor — an incomplete expression of a factor that is represented by a combination of macroeconomic indices and mathematical operators. The left-hand side shows an example of an incomplete factor that is currently missing an index with which GDP will be divided.

The second is the metric of the portfolio when an incomplete factor becomes a complete factor. The right-hand side shows an example of a complete factor with the missing index filled with CPI.

In the middle, there are performance metrics of the final portfolio by taking the long-short position that maximizes the correlation between the allocated asset returns and the macroeconomic factor.

From the training dataset that consists of these two data, the goal of the decision transformer is to infer what should come to replace that missing index in order to yield portfolio returns that come close to these metrics. In fact, Akros creates hundreds of thousands sets of missing and complete factor and performance metrics to train our factor generator. While at the initial stage, the factor generator is close to a random generator that simply makes a random guess as to what the missing index or operator should be filled with, the generator learns to make greater intuitive inferences as to what should come next in order to match the target portfolio metrics that we seek to achieve.

Inference by Factor Generator to find Macroeconomic Alphas

The endgame for the application of a deep generative AI model in asset allocation is that a fully trained factor generator is able to create a macroeconomic factor from scratch given only the target performance metric that we seek to achieve.

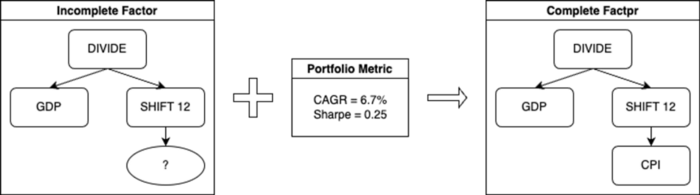

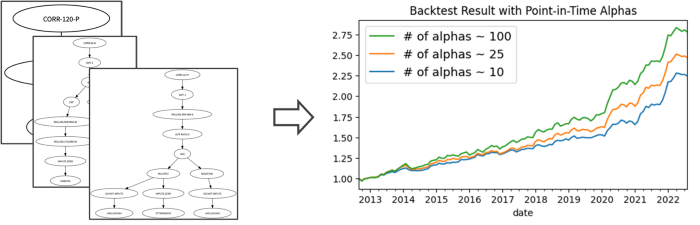

Figure 3 shows the most complex macroeconomic factor found by the factor generator that was trained with a target metric with an HAC-adjusted t-statistic value of 3.0. The nodes at the bottom each represent a different macroeconomic index that is used to formulate this factor and all the other remaining nodes each represent a mathematical operator that is used to calculate the factor. Although such macroeconomic factors may be difficult for us to interpret, we find it meaningful in that it is virtually impossible to find such alpha using the traditional approaches.

Combining Alphas: Why it is important to find alphas efficiently

Using numerous macroeconomic alphas found by factor generator, we allocate each alpha to generate one single combined alpha. The two key points that I would like to highlight are:

- More alphas lead to greater performance

- More alphas mean that over-fitting is less likely

At the end of the day, all quantitative approaches are based on the premise that the great performance of alphas in the past will also lead to the great performance of the same alphas in the future. In order to address the issue, Akros simulates all the backtest of the generative models in point-in-time.

Figure 4 shows the point-in-time simulation of our generative models. Point-in-time simulation means that we revert the time back to January 2013 for instance. Using only the information available precisely at that time, we simulate our models to find 10, 25, and 100 alphas with the given target metric to form a final long-short portfolio. With the help of data and distributed computing infrastructure available at Akros, we repeat the procedure every month to check both the stability of our factor generator and our generated investment strategy to fully validate their performances. Our interpretation from the simulation result is that finding more and greater alphas efficiently increases the possibility of future performance by augmenting the population of the alphas with a greater correlation to future returns and decreases the possibility of overfitting.

Final Remarks: Advantages of Quantitative Generative AI Models

Advantage 1: Flexible for Multiple Purposes

a) Long-only Portfolio after truncating short positions

Since the final portfolio we obtain is a long-short portfolio, we can simply truncate the short position to obtain a fully AI-managed long-only portfolio.

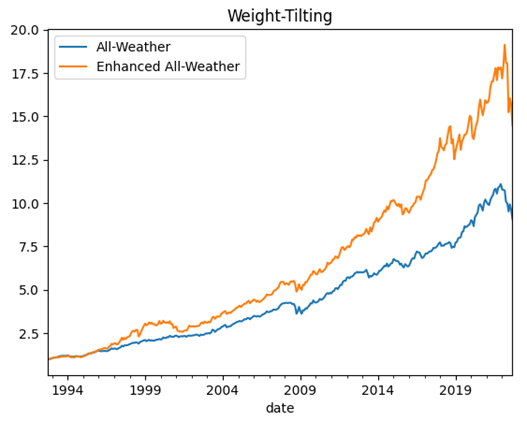

b) Tilting the asset weight of other benchmark multi-asset strategies (like All-Weather Portfolio)

We can provide tactical alphas while preseving the properties of the baseline strategy. Figure 6 shows the our tactical alphas added to the all-weather portfolio to generate greater & steady returns

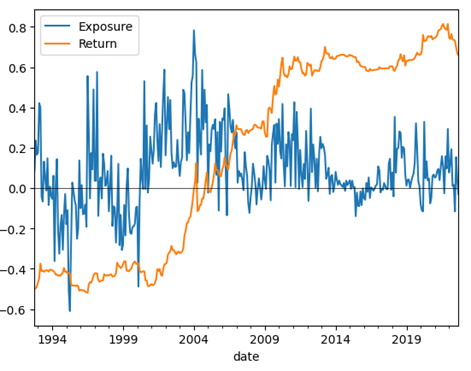

c) Forecasting optimal exposures of each asset class

The optimal exposure of each asset class can be used to determine the portfolio in options trading.

Advantage 2: Customizable Portfolio

a) Changing the definition of Alpha

An aggressive investment strategy can define alpha as a factor that has CAGR greater than 20%. A conservative investment strategy can define alpha as a factor that has a sharpe ratio of greater than 0.7 and maximum drawdown of less than 10%. Our approach is flexible to adjust the definition of an alpha according to the manner of the investment strategy.

b) Changing the target metric of the Factor Generator

Accordingly, the factor generator can be re-trained to adjust the target metric of the final portfolio. Therefore, customized alpha portfolio can be generated in a single operation pipeline.

Advantage 3: Robustness in a Volatile Environment

a) Diverse Investment Strategy using Multiple Factors

More than 500 macroeconomic data are used more than 10,000 factors are generated each month. Our investment strategy is therefore robust to the sudden change of a few variables and makes dynamic changes according to the macroeconomic environment.

Thank you for your time and for those who are interested in learning more about Akros Technologies, you can contact us via email and here are a few links you could refer to!